geico home insurance review 2022, Geico insurance Consumer experience, Geico Homeowners Insurance Discounts,Why to opt for Geico insurance, GEICO...

|

| geico home insurance review 2022 |

geico home insurance review 2022 | digitalskillsguide.com

review geico home insurance 2022

Geico insurance

Geico is one of the largest insurers in the country, but it does not actually offer its own home insurance. Instead, the company works with third-party insurers.

GEICO insurance has been a part of the Berkshire Hathaway insurance family since 1996. While widely known for its auto insurance policies, through its partner network, GEICO also offers affordable homeowners insurance across the U.S. This extensive network includes established, reputable companies such as AIG, American Family, The Hartford, and Liberty Mutual.

Customers do not know which company the home insurance comes from until they ask for a quote - which can lead to a complicated customer experience. However, customers who already have Geico car insurance can get a discount on their car insurance.

Below is detailed information about geico home insurance review 2022.

geico home insurance review 2022 Table of Contents

1. Geico home insurance

2. Geico insurance Consumer experience

3. Geico Home Insurance Review (2022)

4. Geico Homeowners Insurance Discounts

5. Why to opt for Geico insurance?

6. GEICO insurance Standard Home Insurance Coverage Plan

7. Common Factors that Affect the Home Insurance rates

8. Geico Home Insurance Review (2022)

9. Geico Homeowners Insurance Discounts

10. Geico Home Insurance State Availability

11. GEICO Customer Service

13. Compare Other Home Insurance

14. Geico insurance Reviews

15. More about Geico auto insurance

16. Other insurance from Geico insurance

17. Geico insurance Frequently Asked Questions.

17.2 Is Geico a reliable company?

17.3 Does Geico or Progressive have better rates?

Conclusion

1. Geico home insurance

While Geico is best known for its car insurance, it also offers its customers the opportunity to purchase home insurance through its website and agents. However, Geico acts as a broker and refers customers to other home insurers through the Geico Insurance Agency.

This means that a home insurancepolicy taken out with Geico is in fact from another company. If you have already taken out car insurance with Geico, you can get a discount on car insurance when you take out home insurance. However, Geico does not allow you to choose the insurer you are matched with. And once you have taken out your policy, you have to work directly with the third-party provider to manage your policy and file a claim - so bundling offers you few benefits.

2. Geico insurance Consumer experience

You can get a quote for home insurance from one of the Geico branches or find out about different types of insurance. On the website, you will find a list of contact numbers for the various companies in their network, which includes well-known insurers such as The Hartford, Liberty Mutual, and Travellers.

You can view your policy with the Geico app, but you need a Geico auto policy to use it. Depending on the insurer you work with, you may have access to a mobile app with more extensive features.

To file a claim, you will need to contact the partner company where you purchased your policy. Some offer online claim reporting, others require you to report the claim by phone.

On Geico's website, you will find a list of telephone numbers and links to all partner companies. Customer service: Geico has a chatbot that can help you with quick questions. You can also sign up to send direct messages to the company, or call 800-241-8098 with questions about your homeowners' insurance.

geico home insurance review 2022

3. Geico Home Insurance Review (2022)

Home insurance is not always a must, but if you want to protect your most valuable possessions, it's a must. Unfortunately, it can be difficult to find the best home insurance policy for your needs. Companies vary in terms of coverage, cost, availability, customer service, and more. This Old House Reviews team has created this in-depth review of Geico home insurance to help you decide if it's the best policy for you and your home.

Geico has a solid reputation and strong financial backing as the second largest auto insurer in the country. Existing customers can find attractive bundling options that can lower their car insurance premiums. While Geico also offers home insurance, the company acts as a broker and does not offer direct policies.

The company works with 31 insurers, including Liberty Mutual and American Family. This makes claims tracking and customer service even more complicated, and coverage and costs can vary.

This fact has contributed to Geico's overall score of 98 out of 100, which is slightly reduced due to inconvenience. On Geico's Better Business Bureau profile, there are frequent complaints about sudden premium increases and other payment problems. The reviews on the website are mostly negative and refer to poor customer service and price increases.

4. Geico Homeowners Insurance Discounts

Geico typically only offers three discount options, and the dollar value of these discounts could vary between its partners.

If you receive a quote, be aware of any discounts and check your eligibility.

Multiple policies: bundling Geico car insurance and home insurance can lower cartop: 0px; left: 0px; pointer-events: none; z-index: auto;" class="cGcvT">

Read Also: Best Motorcycle Accident Lawyer 2022

5. Why to opt for Geico insurance?

- Available in all 50 states: GEICO homeowners insurance is available nationwide, which makes it easy to shop should you have homes in multiple states, or might be selling your home and uprooting to another state.

- Sterling reputation: As far as consumer complaints go, per the National Association of Insurance Commissioners (NAIC), for GEICO as a whole, there were a total of 348 complaints in 2020. This makes up only 1.018% of complaints in the U.S. market, which is a tiny fraction.

- GEICO insurance has received an A++ rating from AM Best for financial health.

- Customer service agents available 7 days a week: Should you need some assistance, you can talk to a human any day of the week.

geico home insurance review 2022

6. GEICO insurance Standard Home Insurance Coverage Plan

When you purchase a homeowner's insurance policy through GEICO, you're actually getting a policy through one of its partners. It's important to note that for homeowners, renters, and condo insurance, GEICO is an insurance agency.

What does this mean exactly? GEICO's policies are underwritten by insurance companies that aren't affiliated with GEICO. In turn, your policy might vary depending on where you live.

You can expect a standard homeowner's insurance policy to potentially include the following:

Property Damage

This typically covers the cost to repair or replace damage to your house and permanently attached structures — think garages and tool sheds — due to water damage, fire, wind, and hail.

Personal Property Coverage

After a covered loss, this can help recoup the cost to repair or replace personal belongings that were damaged or stolen. Belongings that are covered include furniture, appliances, clothing, and in some cases, dishes.

Jewelry Coverage

Have some valuable jewelry stowed in your home? Should it get stolen, GEICO’s policy offers limited coverage ranging anywhere from $500 to $2,000. You might need to opt for additional coverage for engagement rings, diamond bracelets, and wedding bands.

Personal Liability

Should someone get injured or have their property damaged by you or your pets, should you be faced with a lawsuit, personal liability could help cover the legal costs.

Medical Bills

Let’s say someone who doesn’t live with you becomes injured on your property. Homeowners insurance could pay for the medical bills.

Additional Expenses

This might include the costs to stay elsewhere if your home is uninhabitable due to a peril, such as a fire or a flood.

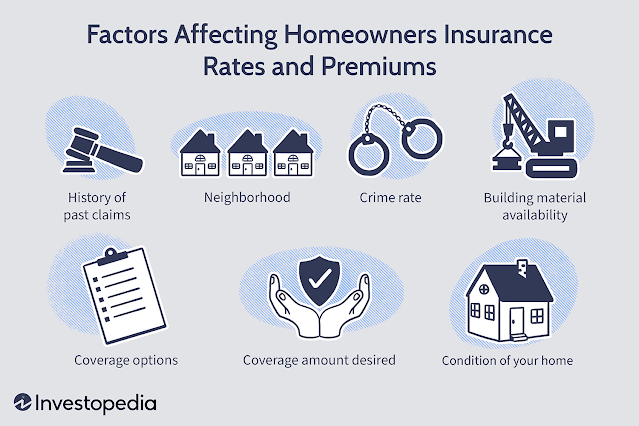

7. Common Factors that Affect the Home Insurance rates

The factors that affect your rates vary according to the insurance company. But standard factors includes;

|

| geico home insurance review 2022 |

- Property location

- Roof condition

- Characteristics of the home

- Previous claims

- Presence of home security systems

- Crime rate

- Incidences of dog bites on the premises

geico home insurance review 2022

geico home insurance review 2022

8. Geico Home Insurance Review (2022)

Home insurance is not always a must, but if you want to protect your most valuable possessions, it's a must. Unfortunately, it can be difficult to find the best home insurance policy for your needs. Companies vary in terms of coverage, cost, availability, customer service, and more. This Old House Reviews team has created this in-depth review of Geico home insurance to help you decide if it's the best policy for you and your home.

Geico has a solid reputation and strong financial backing as the second largest auto insurer in the country. Existing customers can find attractive bundling options that can lower their car insurance premiums. While Geico also offers home insurance, the company acts as a broker and does not offer direct policies.

The company works with 31 insurers, including Liberty Mutual and American Family. This makes claims tracking and customer service even more complicated, and coverage and costs can vary.

This fact has contributed to Geico's overall score of 98 out of 100, which is slightly reduced due to inconvenience. On Geico's Better Business Bureau profile, there are frequent complaints about sudden premium increases and other payment problems. The reviews on the website are mostly negative and refer to poor customer service and price increases.

Read Also: How Much Does Life Insurance Cost in Canada?

9. Geico Homeowners Insurance Discounts

Geico typically only offers three discount options, and the dollar value of these discounts could vary between its partners.

If you receive a quote, be aware of any discounts and check your eligibility.

Multiple policies: bundling Geico car insurance and home insurance can lower car insurance premiums

Security systems for your home: discounts for installing an alarm system

Fire protection systems: You can save with smoke detectors and fire extinguishers.

While GEICO homeowners insurance reviews indicate that its customers are happy with, you can save on your policy by doing the following:

Bundling your policy: By hopping on a multi-policy that includes both homeowners and auto insurance, you can snag a discount.

Home security systems: Installing a home security system increases home safety. In turn, it could bump down the odds of you filing a homeowner's insurance claim for theft or damage to your home.

Installing smoke detector alarms or fire extinguishers: Your premiums might be lowered by installing safety mechanisms or equipment in your abode.

10. Geico Home Insurance State Availability

Geico offers home insurance in all 50 states through its different partners. Alabama | Alaska | Arizona | Arkansas | California | Colorado | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | Washington | West Virginia | Wisconsin | Wyoming

|

| geico home insurance review 2022 |

geico home insurance review 2022

11. GEICO Customer Service

GEICO’s homeowner's insurance customer service team can be reached through its app, online, or by phone, 7 days a week. You can talk to a human Monday through Friday, 7 a.m. to 1 a.m. EST, and weekends from 8 a.m. to 10:30 p.m. EST.

If you live in Hawaii, customer service agents are available weekdays from 7:30 a.m. to 5:00 p.m. HST, and Florida residents can chat with a rep on weekdays from 8:00 a.m. to 9:00 p.m. EST.

12. Benefits of using Geico home insurance

Geico doesn't underwrite its own homeowners insurance policies, meaning that the coverage you purchase from Geico will be serviced by one of its 31 partners. After purchase, any claims or communication will be through the underwriter of your home policy rather than with Geico.

The biggest benefit to choosing Geico for homeowners insurance is the possibility of a bundle discount. Geico doesn't provide an estimate for the exact amount you'll save by bundling your policies together, but in general, this tends to be one of the biggest discounts home insurance companies offer.

We only recommend looking at Geico homeowners insurance if you already use Geico for another type of insurance, such as auto or motorcycle, or you're considering switching. In this case, the possibility of a significant multi-policy discount makes it worth considering.

13. Compare Other Home Insurance

As GEICO insurance is a homeowner's insurance agency that has insurance partners, it’s a bit of hybrid between a comparison site and an insurance company. It’s important to do your research and compare multiple car insurance companies to ensure you get the right coverage at the best price for your needs.

|

| geico home insurance review 2022 |

geico home insurance review 2022

14. Geico insurance Reviews

Geico is not accredited by the Better Business Bureau (BBB), but the company does have an A+ rating from the organization. While there are both positive and negative customer reviews on BBB, its profile shows 1 out of 5 stars from real customers. Here is what some had to say about their experience with Geico.

Courtney H. said:

"I recently had a claim with Geico and they handled the case very poorly from start to finish. First, my claims representative was unresponsive and I had to contact her again and give her information to move the claim forward. Then I used one of their preferred body shops which further damaged my vehicle.

I contacted Geico and they did nothing. I uploaded pictures and an email that I sent to the body shop. The body shop claims to have put new parts on my vehicle but I believe they are used as they are not working properly. Geico has been very nonchalant about this matter and left me hanging. Compared to other insurers they have been the absolute worst to deal with. I will cancel them when this is all over."

Katelyn T. said:

"Unfortunately, I have had to contact Geico several times about various matters. However, I have received superior service each time! Especially the mechanical insurance department. Keep up the good work Geico!"

Douglas M. said:

"I have been going back and forth with them for months. They make two different demands. A) I missed a payment. B) I made a payment but they received it a day late. If you produce my bank statements and prove I did not miss a payment, they go to option B, which basically means you made the payment, we kept it, but ignore it. If that does not work, they go back to option A. After reaching a 'specialist', I was assured that this was completely RESOLVED. Next month it's that time again. I wonder how many 1000s they are trying with this to see if people will just give up and pay them? A third excuse would be that they switched you to bi-monthly payments without your consent or knowledge. Either way, this lizard needs to be fried!"

Geico insurance has best reviews on car insurance also.

|

| geico home insurance review 2022 |

geico home insurance review 2022

15. More about Geico auto insurance

Website: You can learn about and get a quote for many types of insurance through Geico’s website, and you can also submit a claim or make a payment. Additionally, the site has a feature to help you find the cheapest gas station near you.

App: Geico’s mobile offering for iOS and Android helps you keep track of your policy and billing details, access your digital auto insurance ID card, pay bills and submit claims. You can also use the app to request roadside assistance and track your car’s maintenance history.

Voice assistance: Geico’s virtual assistant is a feature of its mobile app that can answer your insurance questions and provide specific policy information. Your Geico account is also accessible through Amazon’s Alexa and Google Assistant.

Geico’s phone number is 800-207-7847.

16. Other insurance from Geico insurance

Geico insurance sells the following types of insurance:

- Motorcycle insurance.

- Insurance for all-terrain vehicles.

- Recreational vehicle insurance.

- Boat or personal watercraft insurance.

- Commercial auto insurance.

- Umbrella insurance (some policies sold by a third party).

- Geico offers other policies through third parties, including:

- Collector insurance for classic cars.

- Condo and co-op insurance.

- Mobile home insurance.

- Pet insurance.

- Life insurance.

17. Geico insurance Frequently Asked Questions

17.1 Who is the best home insurance provider?

NFU Mutual was named the best home insurance company in the country, while Saga came in second, recent rankings show.

geico home insurance review 2022

17.2 Is Geico a reliable company?

Yes, Geico is a good car insurance company. Geico is a good option for drivers who want to pay less for their auto insurance needs. Overall, Geico receives average scores in each of the categories we reviewed, including customer service and claims handling.

17.3 Does Geico or Progressive have better rates?

Is Progressive cheaper than Geico? Both Geico and Progressive offer cheap car insurance to motorists across the country. Geico's rates tend to be lower overall, but Progressive tends to offer cheaper rates for drivers who have recently caused a DUI, an accident, or a traffic ticket.

|

| geico home insurance review 2022 |