what is general liability insurance coverage, General liability insurance definition, What does general liability insurance cover, Liability insurance

|

| what is general liability insurance coverage? |

what is general liability insurance coverage? | digitalskillsguide.com

what is general liability insurance coverage?

what is general liability insurance coverage?

Also known as business liability insurance, general liability insurance protects you and your business from “general” claims involving bodily injuries and property damage. Almost every business has a need for general liability insurance.

General liability insurance definition

General liability insurance can help cover medical expenses and attorney fees resulting from bodily injuries and property damage for which your company may be legally responsible.

General Liability insurance is a policy that helps preserve your business assets by covering legal costs and damages or settlements up to the limit of your policy for covered claims. Although you operate your business with care, accidents can happen.

Below is detailed information about what is general liability insurance coverage?

what is general liability insurance coverage Table of Contents

1. What does general liability insurance cover?

2. What Does Liability Insurance Cover?

3. What Types of Incidents Are Covered Under General Liability?

4. What types of businesses benefit from general liability insurance?

5. What Does a General Liability Policy Cover?

6. What Does General Liability Insurance Cover for a Small Business?

7. What Does General Liability Insurance Not Cover?

8. General liability vs Professional liability

9. The Dangers of Not Having General Liability Insurance

10. Who Needs General Liability Insurance?

11. When Should You Consider Buying General Liability Insurance?

12. Do I Need General Liability Insurance?

13. How Much General Liability Insurance Coverage Do I Need?

14. Is general liability insurance required by law?

15. How Much Does General Liability Insurance Cost?

16. How Do I Purchase General Liability Insurance?

17. What Determines My Insurance Cost?

18. Does General Liability Insurance Cover All My Legal Risks?

19. The Risks of Not Having General Liability Insurance

Conclusion

Read Also:

what is general liability insurance coverage?

1. What does general liability insurance cover?

General liability insurance policies typically cover you and your company for claims involving bodily injuries and property damage resulting from your products, services or operations. It may also cover you if you are held liable for damages to your landlord’s property.

General liability insurance doesn’t cover employee injuries, auto accidents, punitive damages (in most states), workmanship, intentional acts or professional mistakes.

2. What Does Liability Insurance Cover?

What does liability insurance cover Many small business owners have a general liability insurance policy to help protect their companies. You may be asking yourself, “What does general liability cover?” This insurance helps protect your business from claims that it caused:

- Bodily injury

- Property damage

- Personal injury, like libel or slander

what is general liability insurance coverage?

3. What Types of Incidents Are Covered Under General Liability?

General liability insurance helps protect your small business from claims that it caused bodily injuries and property damage. These risks can come up during normal business operations. They can get expensive for small businesses and many don’t have the resources to cover a liability claim.

Did you know the average cost of a slip and fall claim is $20,000?1 And if you’re faced with a reputational harm lawsuit, be prepared that they can cost about $50,000.2 Without general liability insurance coverage, your business would have to pay these costs out of pocket.

4. What types of businesses benefit from general liability insurance?

The types of businesses that typically buy general liability insurance include:

- Small business owners

- Landscaping companies

- IT contractors

- Real estate agents

- Consultants

- Marketing firms

- Janitorial services

- Artisan contractors

what is general liability insurance coverage?

5. What Does a General Liability Policy Cover?

What does general liability cover A general liability policy helps cover claims that can come up during normal business operations, such as:

- Bodily injuries that your business may have caused. This can include customer slip and falls. General liability coverage can help pay for their medical expenses.

- Property damage from employee accidents, like breaking a client’s windows while working at their home. This insurance can help cover the repair or replacement costs to fix the windows.

- Personal injury, like libel or slander. General liability can help pay for your business’ defense costs if it gets sued.

6. What Does General Liability Insurance Cover for a Small Business?

What does general liability insurance cover General liability insurance, also known as commercial general liability insurance or business liability insurance, helps cover:

- Costs for property damage claims against your business

- Medical expenses if someone gets injured at your company

- Administrative costs to handle covered claims

- Court costs, judgments and settlements for covered claims

Your general liability insurance can help pay for claims up to your coverage limits.

7. What Does General Liability Insurance Not Cover?

Be aware that general liability insurance doesn’t cover every kind of claim. For some, you’ll need different types of coverage to give your business more protection.

A general liability insurance policy won’t help your business with:

Commercial auto accidents that you or your employees cause while driving for work. A commercial auto insurance policy can help you cover the cost of damages. If your small business doesn’t have company-owned vehicles, hired and non-owned auto coverage could help, too. Be aware that many states require certain types and amounts of auto coverage, like bodily injury liability coverage or property damage liability coverage.

Employee injuries or illnesses due to their work. Workers’ compensation insurance gives your employees benefits to help them recover from a work-related injury or illness. For example, it can help cover an employee’s medical bills and ongoing care expenses.

Depending on your state, you can get this insurance from a:

- Private insurance company

- State-run agency

- Monopolistic state fund

Damage to your own business property. You’ll need to get a commercial property insurance policy to help protect your owned or rented building and business equipment.

Mistakes or errors in the professional services given to customers. Professional liability insurance can help cover your legal costs if a client sues you for a mistake in the services provided.

Claims that cost more than your liability limits. You’ll need a commercial umbrella insurance policy for expensive claims. This extends the limits of certain liability insurance policies.

Illegal acts or wrongdoing that you or your employees did purposefully.

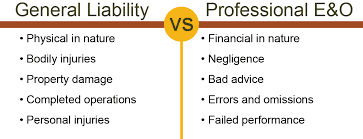

8. General liability vs Professional liability

General liability vs Professional liability differences are shown below;

|

| what is general liability insurance coverage? |

what is general liability insurance coverage?

9. The Dangers of Not Having General Liability Insurance

Judgments, settlements, legal defense fees and court costs can be extremely expensive. If someone files a claim against your business:

- You’ll need legal counsel, which can cost over $100 per hour3

- The maximum amount could easily exceed $75,000 if the claim ends up in court4

- You may need to spend several thousands of dollars, even if the lawsuit gets dropped

When you add the cost of administrative work, legal secretaries and any settlements or judgments, your business could face a bill totaling hundreds of thousands of dollars. The right general liability insurance policy can help your business cover these costs.

10. Who Needs General Liability Insurance?

State laws generally don’t require you to carry general liability insurance. However, not having coverage could put your business at financial risk.

You may also find that businesses will want to make sure you have the minimum coverage they require before agreeing to work with you. They want to make sure your business can survive a liability claim and continue to do what they hired you to do. So, they may ask you to provide proof of insurance, also known as a certificate of liability insurance.

Who Needs General Liability Insurance?

Here are situations where you’d benefit from business liability insurance coverage:

- Your business is open to the public or clients or vendors.

- You advertise or create marketing materials for your business.

- You use social media personally or professionally.

- You use third-party locations for business activities.

- You need insurance coverage in order to be considered for work contracts.

- You have temporary employees.

11. When Should You Consider Buying General Liability Insurance?

General liability insurance is an essential coverage for many business owners. You may want to consider getting coverage if you:

- Have a store, office or building that’s open to the public, clients or vendors

- Handle or work near client property

- Advertise or create marketing materials for your business

- Use social media personally or professionally

Get the Right Liability Coverage for Your Business

Many insurance companies offer general liability insurance, but not all of them specialize in small businesses. Seek for experience insurance company.

12. Do I Need General Liability Insurance?

While General Liability insurance isn't typically legally required, it helps protect you and your business from the potentially crippling costs when lawsuits arise, and promotes ease of doing business.

There may be circumstances where you're required to show proof of General Liability insurance when signing a contract or applying for a license in specific states. Certain customers – especially large organizations – may have General Liability insurance requirements before they'll hire you as a vendor. General Liability insurance may be required for some types of professional licenses, such as plumbing or electricians. Finally, property management firms may require that you have General Liability insurance before they'll rent you space.

Read Also: What Is Liability Car Insurance?

13. How Much General Liability Insurance Coverage Do I Need?

Most small businesses choose standard coverage amounts of $1 million per occurrence and a $2 million aggregate policy limit for their general liability insurance coverage, according to Insureon. This type of policy will pay up to $1 million to cover a single general liability insurance claim, with a $2 million limit for all claims during the policy period. The policy period is typically one year.

14. Is general liability insurance required by law?

Business liability insurance isn’t required by law, but if you fail to buy coverage, you’re leaving your business vulnerable to a wide variety of costs that could potentially bankrupt your business.

15. How Much Does General Liability Insurance Cost?

General liability insurance costs an average of $42 per month, according to Insureon. It might be less than that—17% of Insureon’s small business customers pay less than $25 per month for their general liability policies.

The cost of general liability insurance coverage varies based on the size of the business, your industry, your location and the amount of coverage you need.

You can manage general liability insurance costs by choosing the insurance limits that best meets your needs. A business owners policy (BOP) is a convenient and cost-effective way to combine general liability insurance and business property insurance. But you also can buy general liability insurance all on its own.

Factors that determine how much you pay for general liability insurance:

Your type of business. If your company is a high-risk business, you pay a higher cost for general liability insurance.

- The years of experience of your business.

- Size, location, condition of your building.

- Policy details, such as deductibles and coverage limits.

- The insurance claims history for your business.

what is general liability insurance coverage?

16. How Do I Purchase General Liability Insurance?

General Liability policies may be purchased stand-alone or as part of a comprehensive Business Owner's Policy. Your insurance agent can help you customize your coverage to address the specific risks facing your business. They can also assist in setting up the policy and teach you some smart business practices that may help you avoid unnecessary claims.

17. What Determines My Insurance Cost?

The cost of your General Liability insurance may depend on several factors including:

Type of business;

- Unique coverage needs, customized to your particular operations;

- History of insurance claims;

- The size of your business;

- Location.

Certain industries and jobs that are more dangerous or have a higher risk of lawsuits may have higher General Liability premiums. Larger companies or those with a history of multiple General Liability claims may pay more.

18. Does General Liability Insurance Cover All My Legal Risks?

General Liability insurance is a smart starting point for business protection. However, it doesn't protect against every claim that might arise. Claims related to the quality of your work or professional negligence generally are not covered. For protection against the costs of these types of claims, you can purchase Errors and Omissions or Professional Liability insurance.

You can customize General Liability insurance coverage to address the needs of your business. For example, you may also want to consider specific types of liability insurance, such as liquor liability or pollution liability, that provide relevant coverage for risks unique to your business.

For additional protection, an Umbrella Policy can provide higher limits of insurance to supplement your primary General Liability coverage.

For more information about General Liability and other business insurance solutions, contact insurance companies near you by searching for, "insurance company near me'.